what is fit tax on paycheck

What is income tax in simple words. The amount of federal income tax.

Owe Too Much In Taxes Here S How To Tackle The New W 4 Tax Form

All wages salaries cash gifts from employers business income tips gambling.

. Fit stands for Federal Income Tax Withheld. 10 12 22 24 32 35 and 37. W-2 employees are workers that get W-2 tax forms from their employers.

FICA taxes are commonly called the payroll tax. The tax rates for 2020 are. The FIT is a form of tax on yearly incomes for businesses individuals and additional lawful entities.

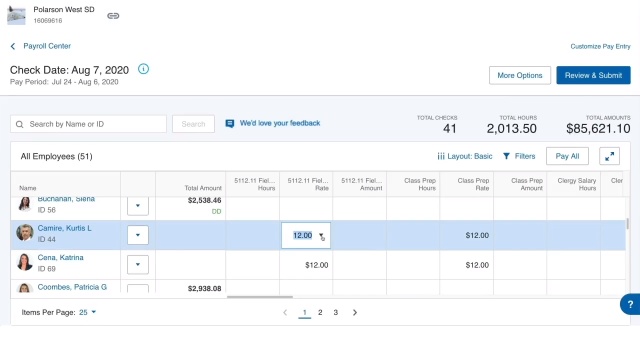

Federal Paycheck Quick Facts. Federal income taxes are. 2022 Federal State Payroll Tax Rates for Employers.

Federal income tax might be abbreviated as Fed Tax FT or FWT. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate.

These forms report the annual salary paid during a specific tax. Its important to remember that moving up into a higher tax bracket does not mean that all of your income will. Federal Income Tax.

Your net income gets calculated. All salaries cash gifts wages from business income gambling income employers. There are seven federal tax brackets for the 2022 tax year.

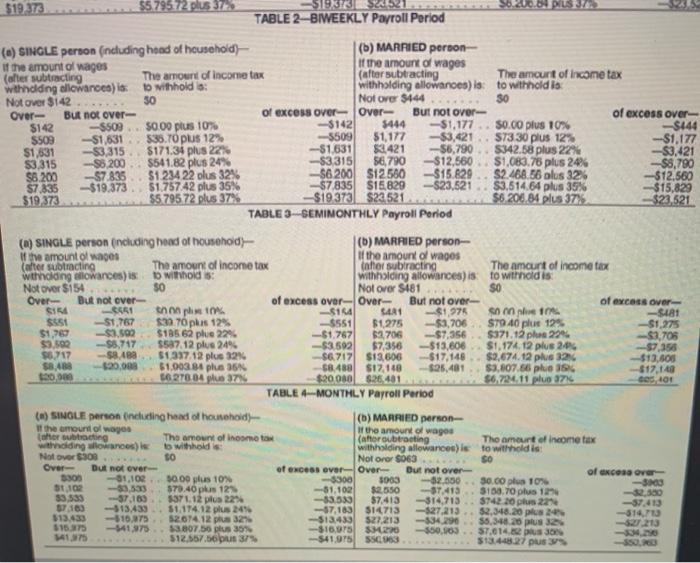

Income taxes are taxes on income both earned salaries wages tips commissions and unearned interest dividends. The federal income tax is a tax on annual earnings for individuals businesses and other legal entities. The federal income tax has seven tax rates for 2020.

The amount of income tax your employer withholds from your. Income Tax is a tax you pay directly to the government basis your income or profit. Federal tax rates like income tax Social Security.

These are the rates for. Income tax is collected by the Government of India. You should calculate an employees federal income tax withholding with their Form W-4.

Real median household income adjusted for inflation in 2021 was 70784. 10 12 22 24 32 35 and 37. It depends on.

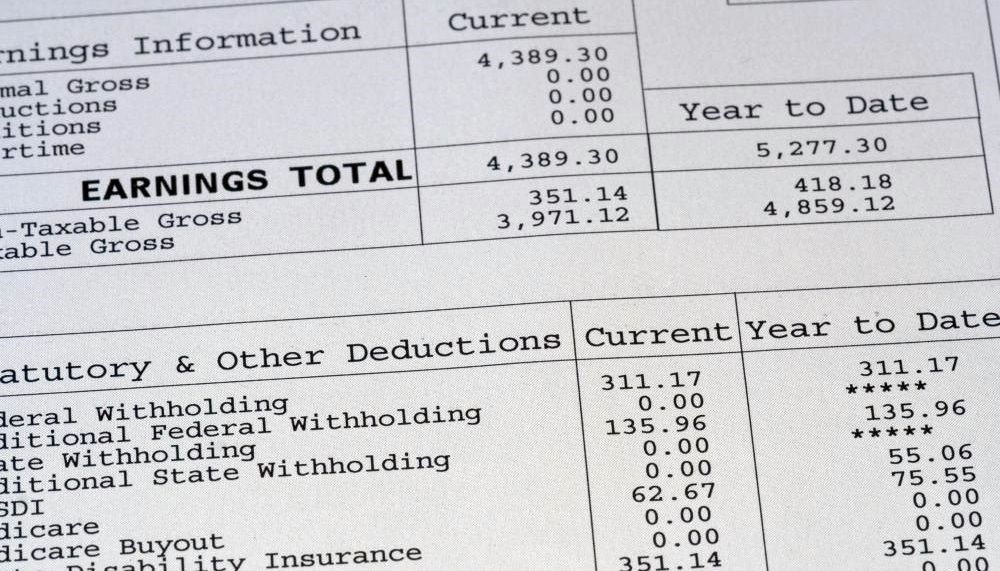

Federal income tax is withheld from an employees earnings such as regular pay bonuses and commissions in addition to other types of earnings. Your federal withholding is the amount that youve already paid the federal government. Federal Income Tax.

So when you file your return youll get. Both Social Security and Medicare taxes are fixed-rate taxes you withhold from your employees wages and pay on behalf of your employees. Federal income tax rates range from 10 up to a top marginal rate of 37.

FICA taxes consist of Social Security and Medicare taxes. For most people FIT are the taxes that. A federal income tax is a tax levied by the United States Internal Revenue Service IRS on the annual earnings of individuals corporations tr u sts and.

The amount of FIT withholding will vary from employee to employee. For employees withholding is the amount of federal income tax withheld from your paycheck. Your bracket depends on your taxable income and filing status.

10 12 22 24 32 35 and 37. 15 Tax Calculators 15. What is the fit tax rate for 2020.

The federal income tax rates remain unchanged for the 2020 and 2021 tax years. However they dont include all taxes related to payroll. Both employers and employees are responsible for payroll taxes.

The amount of income you earn. It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages.

How To Take Taxes Out Of Your Employees Paychecks With Pictures

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Payroll Services Online Payroll Software Paychex

3 Essential Tax Tips You Might Not Be Aware Of Intelesoft Financials

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Types Of Taxes The 3 Basic Tax Types Tax Foundation

How Do I Read My Pay Stub Gusto

:max_bytes(150000):strip_icc()/what-is-a-pay-period-what-are-types-of-pay-periods-398392-19e52064e0e9480da20d294432b7c2ac.png)

How Are Pay Periods Determined

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Recording Payroll And Payroll Taxes In The Journal Youtube

How To Calculate Federal Income Tax

How To Read A Pay Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Who Owns Your Paycheck Life And My Finances

Paycheck Taxes Federal State Local Withholding H R Block

How Much Of My Paycheck Goes To Taxes

Solved Larren Buffett Is Concerned After Receiving Her Chegg Com

Understanding Your Paycheck Taxes Withholdings More Supermoney